“ARMONK, N.Y., – 18 Aug 2011: Today, IBM (NYSE: IBM) researchers unveiled a new generation of experimental computer chips designed to emulate the brain’s abilities for perception, action and cognition … cognitive computers are expected to learn through experiences, find correlations, create hypotheses, and remember – and learn from – the outcomes, mimicking the brains structural and synaptic plasticity.

“ARMONK, N.Y., – 18 Aug 2011: Today, IBM (NYSE: IBM) researchers unveiled a new generation of experimental computer chips designed to emulate the brain’s abilities for perception, action and cognition … cognitive computers are expected to learn through experiences, find correlations, create hypotheses, and remember – and learn from – the outcomes, mimicking the brains structural and synaptic plasticity.

IBM Unveils Cognitive Computing Chips, Press Release, IBM, August 18, 2011.

—————

“IBM sees multiple applications for these cognitive computing systems, which would fit in the size of a shoebox. Among potential uses:

- Computers that could take in inputs such as texture, smell and feel to gauge whether food was outdated.

- Financial applications to monitor trading and recognize patterns in a way today’s algorithms can’t.

- Traffic monitoring.

- And system monitoring for waterways and other natural resources.”

Larry Dignan, IBM creates cognitive semiconductors: A step toward right brain computers, ZDNet Blog Between the Lines, August 17, 2011.

—————

—————

———————–Comments———————–

The barriers to replacing intellectual and professional workers with machines are rapidly falling. Already, computers are taking over customer service communications, digital archive research, teaching responsibilities, aspects of legal research, stock market trading, and other information gathering, information evaluation, and decision-making activities. With new computational technologies moving into the world’s workplaces almost everyday, the pace at which intellectual and professional work activities are being turned over to computers is accelerating.

The impact of this trend on global and U.S. employment can only be negative. In every field of business, the world is crowded with competitors and the global rules governing competition are minimal and poorly enforced. In this environment, no business leader can risk not looking at every new computational technology as a possible way to reduce labor costs faster than do competitors.

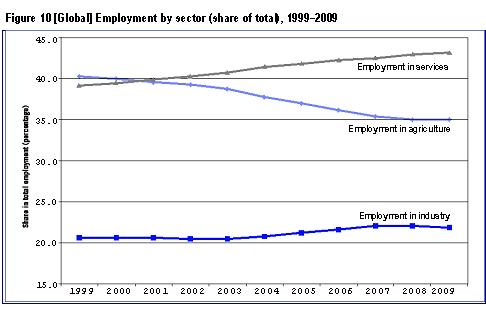

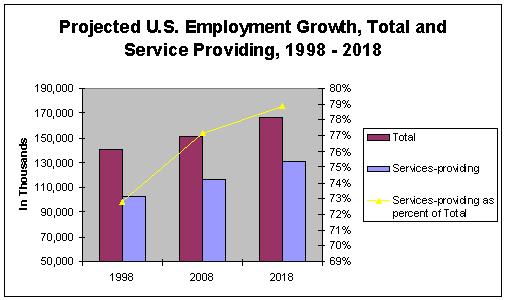

A very large proportion of the jobs that involve observation, evaluation, and decision-making activities are in service providing industries, including government, so the largest part of the negative employment impact of the accelerating use of computational technologies that emulate aspects of human thinking will be in this sector. But the overall impact will be much greater.

Neither the agricultural sector, which is rapidly losing workers to automation, nor the industrial sector, which is already highly automated, will be able to absorb the very large numbers of workers likely to be displaced from service sector jobs. Unemployment and underemployment will rise, and as they do non-work entitlements to income will have to play a much larger role in distributing the wealth created by the enormous and growing productive power of the world economy.

Otherwise, the future will be tragic. The proportion of the world’s people living in poverty will increase, morbidity and preventable deaths will rise, the growth of the world’s middle class population will stagnate, and political upheavals and brutal governmental repressions will grow more numerous.