Inflation is “a gradual loss of purchasing power that is reflected in a broad rise in prices for goods and services over time.”[1] It is a market economy phenomenon that arises when demand for goods and services exceeds the supply of those goods and services. Rising incomes can offset some or all of the purchasing power loss, but not everyone in a population will get sufficient income growth to do so. Political tensions inevitably grow as inflation persists and more people lose purchasing power.

In the long history of the capitalist modern world-economy, periods of inflation have been generated by supply chain disruptions that cause the expansion of production to fall behind the expansion of demand — disruptions usually caused by economic and shooting wars, by production encounters with food production or mineral extraction barriers (e.g., exhaustion of crop lands, depletion of deposits of coal, oil, or other critical resources), and occasionally by a pandemic or labor shortage. However, in time wars and pandemics end and technological breakthroughs and mineral deposit discoveries restore the growth of resource inputs into production. Supply side growth catches up with demand side growth.

In the past, restoring the balance between supply and demand worked because the carrying capacity of the earth-system could handle intensified extraction of minerals, intensified harvesting of plants and animals, and intensified dumping of pollutants into the air and water without generating destructive phenomena that most humans could not escape. As populations grew and more powerful technologies were developed and implemented and mass marketing transformed more and more of the world’s people into consumers with unlimited appetites for everything modern, the expansion of production capacity could generally keep pace with or catch up with and sometimes outpace the growth of demand. The relationship between supply and demand cycled through periods of imbalance and balance.

That capacity in the capitalist modern world-economy for governments and capitalists to restore balance following a period of imbalance came to an end in the late 20th century. Human activities finally pushed the the earth-system beyond its carrying capacity limits.

Chronic Inflation

The capitalist modern world-economy has entered into a unique era of processes and trends that interact to form two conjunctural forces that make inflation chronic. The key processes and trends in this conjuncture are continuing world population growth, expected to reach 10.3 billion in the 2080s,[2] continuing consumer and business demand growth as all of the world’s people continue to aspire to western middle class lifestyles, the intensifying development of mineral extraction and food and shelter production technologies as producers race to keep up with growing demand, and the accelerating impingement of the earth-system’s carrying capacity limits on production expansion. One conjunctural force is the combination of population growth with consumption aspirations built into middle class cultures and constantly reinforced by global marketing campaigns. The other conjunctural force is the accelerating rise in living costs generated by the mutually reinforcing interactions between the world’s production activities and the carrying capacity limits of the earth-system. Every increase in production brings with it an intensification of costly repercussions from the earth-system[3] and further stimulation of unrelenting demand growth. In the other direction, the growing number and intensity of costly repercussions from the earth-system create political pressures to accelerate the development and implementation of technologies intended to reduce costs and ameliorate damages, while still satisfying popular expectations for lifestyle improvements. This is a vicious cycle of systemic destructiveness that is now driving inflation and will not relent for decades.

More and More Bad Jobs

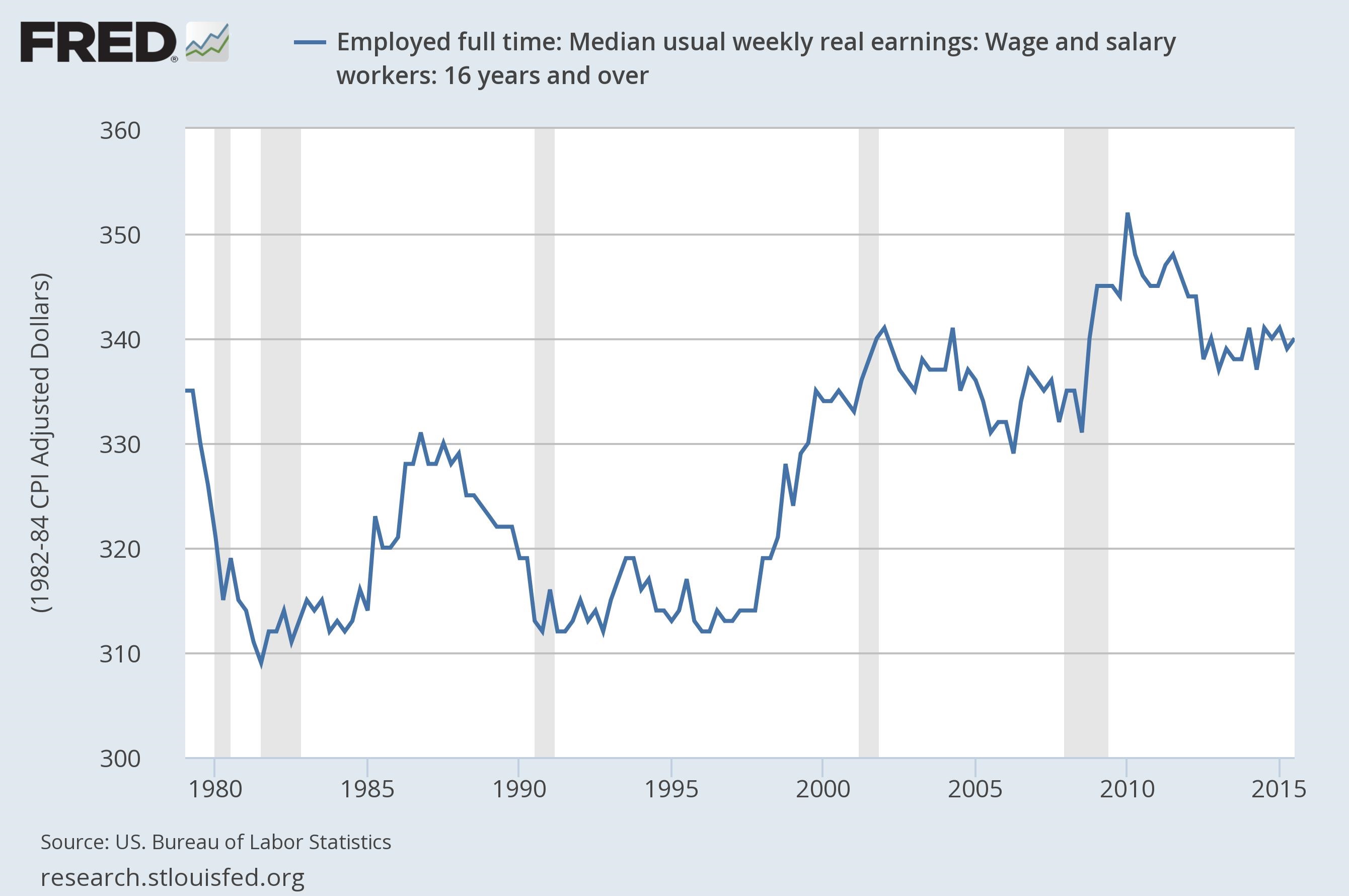

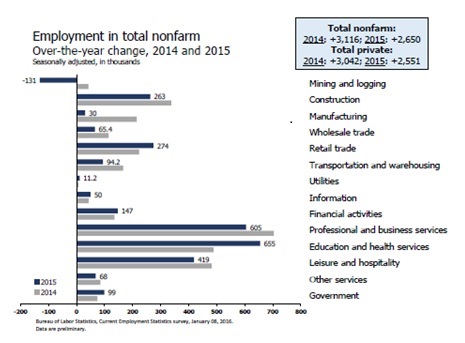

In this era of chronic inflation, the only way to rebalance supply and demand is to bring down demand so that the production of goods and services does not have to continue to expand and consequently intensify the costly repercussions from the overtaxed earth-system. In theory, this could be done equitably. However, the capitalist modern world-economy is a strongly top-down social-system; inequalities of wealth and power are enormous and growing. The wages and working conditions of working people and the economic protections for the poor are already being diminished by public and private institutions and will continue to be. Moreover, and more ominously for the fate of representative democracy, the wages and working conditions of many currently middle class workers will almost certainly come under increasing attack, as the rich and their well-heeled hirelings (managers, lawyers, and politicians) take actions to protect their wealth and purchasing power from the ravages of chronic inflation.

Of course, as inflation and adverse policies cut away at the world’s middle classes, resistance movements will grow and make stronger and stronger demands for more political accountability, limits on profits, and higher taxes on the wealthy. Those efforts, which are piecemeal now, are being met with brutal suppression and if history is a guide, will continue to be for the foreseeable future. The niceties of democracy will not be allowed to get in the way of the interests of the rich and their economic and political friends. History also tells us that at some point suppression fails. As participation in resistance movements grows and global coordination among resistance movements increases, the moment of suppression failure will arrive. For now, the global forces of suppression are powerful and growing, so that global moment of defeat for the forces of suppression is almost certainly decades away.

[1] Jason Fernando, “What is Inflation,” Investopedia, Updated September 27, 2024. https://www.investopedia.com/terms/i/inflation.asp.

[2] “Growing or shrinking? What the latest trends tell us about the world’s population”, United Nations July 11, 2024. https://news.un.org/en/story/2024/07/1151971.

[3] Such as higher costs for extracting minerals, higher costs for replacing property destroyed by extreme weather events, higher costs for maintaining the fertility of croplands, higher costs for adapting lifestyles and production activities to rapidly changing environmental and geopolitical conditions.