“Mr. Toprak said more consumers also were showing up at dealerships because their current vehicle had outlived its useful life and they had no choice but to buy a replacement.”

Nick Bunkley, U.S. Vehicle Sales Soared Nearly 10% in September, Despite Economic Gloom, New York Times, October 3, 2011

—————

“But other factors boosted truck sales. Small businesses must eventually replace aging fleets of work trucks…”

Associated Press, US auto sales rise in September as consumers buck trends and buy trucks, Washington Post, October , 2011

—————

“Personal income decreased $7.3 billion, or 0.1 percent, and disposable personal income (DPI) decreased $5.0 billion, or less than 0.1 percent, in August …Real disposable income decreased 0.3 percent in August, compared with a decrease of 0.2 percent in July.”

Personal Income and Outlays: August 2011, New Release, Bureau of Economic Analysis, U.S. Department of Commerce, September 30, 2011

—————

“But the companies will be able to contain their costs by not paying annual raises to their U.S. factory workers and by hiring thousands of new workers at lower wage rates.”

Dee-Ann Durbin and Tom Krisher (Associated Press), Ford to pay workers $6,000 bonus, Lansing State Journal, Oct. 4, 2011

—————

“Retailers are coming to terms with a new reality: the consumer who traded down during the recession and never came back.”

Ann Zimmerman, Frontier of Frugality, Wall Street Journal, October 4, 2011

———————–Comments———————–

September’s jump in vehicle sales did not signal a change in the behaviors of global investors, corporations, and governments that currently translate consumer decisions into employment and income outcomes. Global investment decisions still favor machines over workers and still favor nations with low wages, weak regulations, corruptible government officials and/or growing populations of people with disposable income. Global economic growth is still slowing; employment opportunities are still disappearing; opportunities for investors and corporations to pit desperate nations and workers against each other in bidding wars for investments and jobs are increasing.

In this context, September’s jump in vehicle sales can’t be read as good news for U.S. working families and small business owners. The economic benefits will be minimal and short lived.

Consumers and small businesses locked themselves into loan payments that reduce other spending: Auto sales were driven by frustrations with aging vehicles and other factors, not by income growth that had increased savings for down payments and created extra spending capacity to cover new loan payments. It is thus very likely that tens of thousands of families and small businesses are now locked into years of new auto loan payments they can’t afford. And global circumstances virtually insure that family incomes in the U.S. will stay flat or even decline over the next year. Consumers and small businesses must either reduce spending on other items or take on more debt.

More debt, of course, means a larger share of income goes to loan payments. Sooner or later, unless incomes rise enough to offset loan payments, consumer demand and business-to-business demand will fall.

With the holiday season coming, retailers may be the first to see sales losses as consumers cut back on optional spending so they can make auto loan payments.

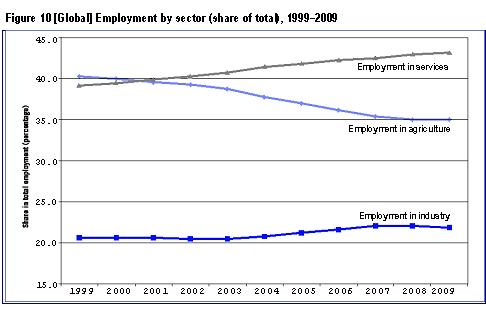

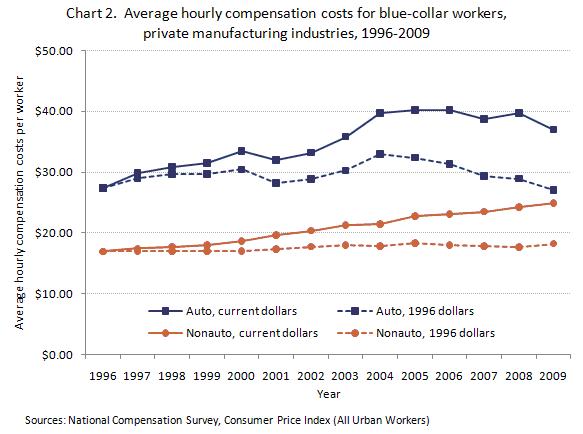

Employment and income benefits for U.S. families are minimized by global supply chains and global wage and benefit inequalities: These days, “made in the U.S.” really means assembled in the U.S. Many of the parts that become a finished vehicle here are produced outside the U.S. Thus, a jump in U.S. auto sales generates job and income growth in other nations as well as in the U.S. Moreover, the U.S. share of total job and income growth from auto sales declines over time.

Because of huge wage and benefit inequalities across nations the families in other nations that get income increases as a result of U.S. auto purchases will spent most of their extra income on goods and services produced in the U.S. — in the emerging economies (e.g., Brazil, Russia, India, China) where many high tech consumer and business goods are produced more cheaply than in the U.S. and in low wage nations that produce all the other consumer basics (blankets, dinner ware, clothing, etc.) that are mostly not produced in the U.S. (except when produced by U.S. crafts people and a select few U.S. companies that market to wealthy and status conscious consumers).

Interest on loans goes into bloated investment funds, and from there to other nations and into financial bubbles: In the early days of a loan, the part of a loan payment that goes to interest is typically at its highest. Thus, for the immediate future, September vehicle sales will be pumping cash into the hands of bankers and other investors. Under current global circumstances, this does not benefit U.S. families

It has become well known that U.S. corporations and investors are aggressively pursuing investment opportunities in parts of the world with growing populations of middle class consumers. It is thus very likely that a large part of the loan payments on the new vehicles will generate jobs outside the U.S. and strengthen global competitors to smaller U.S. businesses.

Concern about the formation of new financial bubbles has been mounting because the investment world is flush with cash and a stagnant world economy has reduced the number of sound investment opportunities. Pumping more cash into the investment world under these circumstances can only increase the risk that cash rich but profit-hungry investors will herd themselves into unsound investment trends.