ITEMS FOR YOUR CONSIDERATION

Data source: Labor Force Statistics from the Current Population Survey, Bureau of Labor Statistics

Data source: Labor Force Statistics from the Current Population Survey, Bureau of Labor Statistics

—————

Private Sector Job Growth is Dominated By Lower Wage IndustriesPercent of Private Sector Job Growth By Selected Industries |

|||

|

Jan-11 |

Dec-11 |

Jan-12 |

|

| Goods-Producing |

30.3% |

32.3% |

31.5% |

| Private Service-providing |

69.7% |

67.7% |

68.5% |

| Retail Trade |

31.0% |

2.8% |

4.1% |

| Temporary Help Services |

13.5% |

3.8% |

7.8% |

| Leisure and Hospitality |

-6.7% |

8.6% |

17.1% |

| Other services |

-5.9% |

2.3% |

2.7% |

| Total 4 Selected Service Providing |

31.9% |

17.5% |

31.8% |

|

Data source: Employment Situation Summary Table B, Employment News Release, Bureau of Labor Statistics, February 3, 2012. |

|||

—————

Job Cuts, January 2012 Greater than in January 2011(Ten Industries with Highest Cuts) |

||

|

January 2012 |

January 2011 |

|

| Retail |

12,426 |

5,755 |

| Financial |

7,611 |

2,822 |

| Pharmaceutical |

4,071 |

2,090 |

| Entertainment/Leisure |

3,910 |

1,545 |

| Aerospace/Defense |

3,634 |

3,167 |

| Government/Non-Profit |

3,021 |

6,450 |

| Food |

3,000 |

873 |

| Consumer Products |

2,464 |

1,783 |

| Industrial Goods |

2,230 |

1,874 |

| Transportation |

1,770 |

725 |

| Data Source: 2012 Kicks Off With 28% Surge in Job Cuts, Press Release, Challenger, Gray & Christmas, February 2, 2012. |

||

—————

January 2012 Purchasing Managers’ Index (PMI) for Manufacturing Lower than in 2010 and 2011 |

||||

|

2010 |

||||

|

January |

April |

July |

Oct |

|

|

56.7 |

59.0 |

55.7 |

57.0 |

|

|

2011 |

2012 |

|||

|

January |

April |

July |

Oct |

January |

|

59.9 |

59.7 |

51.4 |

51.8 |

54.1 |

| Data source: table of Manufacturing Business PMI history, Institute for Supply Management. | ||||

—————

“The man in charge of a firm with several hundred thousand staff around the world bemoaned that, ‘we live in a world where wealth creation is uncoupled from job creation. This once close connection is ruptured.'”

Tim Weber, Davos 2012: Youth unemployment ‘disaster’, BBC News website, January 28, 2012.

—————

SMBs in developing countries are keeping pace with their more developed counterparts when it comes to providing employees with smartphones, netbooks/mini notebooks, and media tablets. In some cases, they are actually more likely to provide these products to their staff.

The Consumerization of IT Helps Level the SMB Playing Field Across the World, IDC Says, Press Release, International Data Corporation (IDC), January 25, 2012.

—————

“This suggests that the labor market has changed in ways that prevent the cyclical bounceback in the labor market that followed past recessions. … Stricter market incentives to control costs in the face of stiff domestic and international competition may also be factors. In addition, anecdotal evidence suggests that recent employer reluctance to hire reflects an unusual degree of uncertainty about future growth in product demand and labor costs. These special factors are not readily addressed through conventional monetary or fiscal policies. But such policies may be able to offset the central obstacle of weak aggregate demand.”

Rob Valletta and Katherine Kuang, Why Is Unemployment Duration So Long?, Federal Reserve Bank of San Franscisco Economic Lettter, January 30, 2012.

COMMENTS

The only way to arrive at optimism about U.S. employment is to focus attention on indicators that are poorly related to unemployment changes (GDP growth, initial unemployment insurance claims, the traditional unemployment rate) and ignore global economic forces that continue to spell trouble for U.S. employment growth

Misleading indicators:

- An uptick in the rate of GDP growth is misleading about employment growth because machines now play such a large role of in the production and sale of goods and services in the U.S.; modest upswings in GDP can take place with almost no impact on employment

- Initial claims for unemployment insurance (UI) get a lot of press, but only about 43 percent of unemployed workers receive UI; unemployment among workers who mostly do not qualify (many workers in retail and service industries) can rise or fall dramatically with little impact on initial claims

- As is well known, the traditional unemployment rate is a downwardly biased measure of unemployment; it does not count as unemployed persons who have opted to do something other than look for work until prospects improve (e.g., going to school, taking a self-financed sabbatical, making repairs to the house) and does count as employed persons who want full time employment but can only find part-time employment and persons who are working in jobs beneath their qualifications.

Global forces that undercut U.S. job growth are still in play:

- Global and U.S. GDP growth rates will be modest through at least 2012 because of financial turmoil, lots of supply, and weak demand

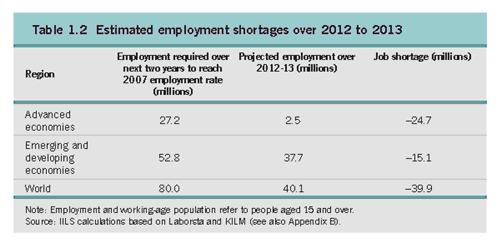

- The number of competing nations in the world economy has not diminished and very high levels of unemployment are pushing many nations to become even more aggressively competitive

- Slow global market growth continues, which means the world’s global businesses must continue to relentlessly cut labor and other costs to survive

- Emerging market countries with skilled workers, advanced production capacities, and much lower production costs will continue to outbid the U.S. for the investments that produce the most jobs per dollar of investment

- Facing higher production costs in the U.S., much of the investment in the U.S. will continue to be in high tech, high profit activities that produce relative few jobs, and those jobs will be ones for which very few U.S. workers have the required skills.

The labor force participation rate, which is a better indicator of whether we should be optimistic about job growth, has been trending downward for many years. Taken as a whole, economic signals indicate that this trend is locked in, whatever economists and reporters may wish to read into short term economic indicators.