SOURCE ITEMS

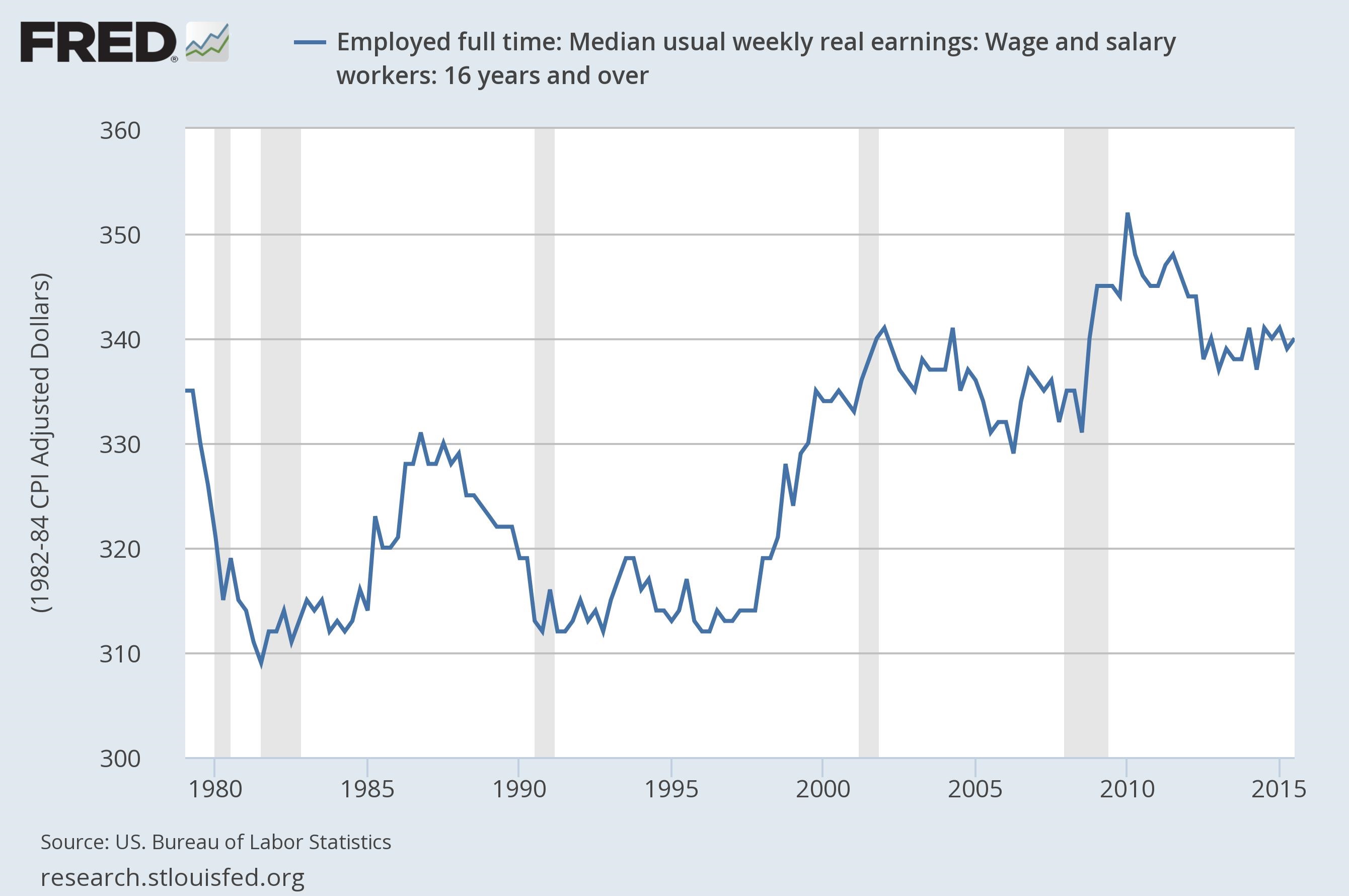

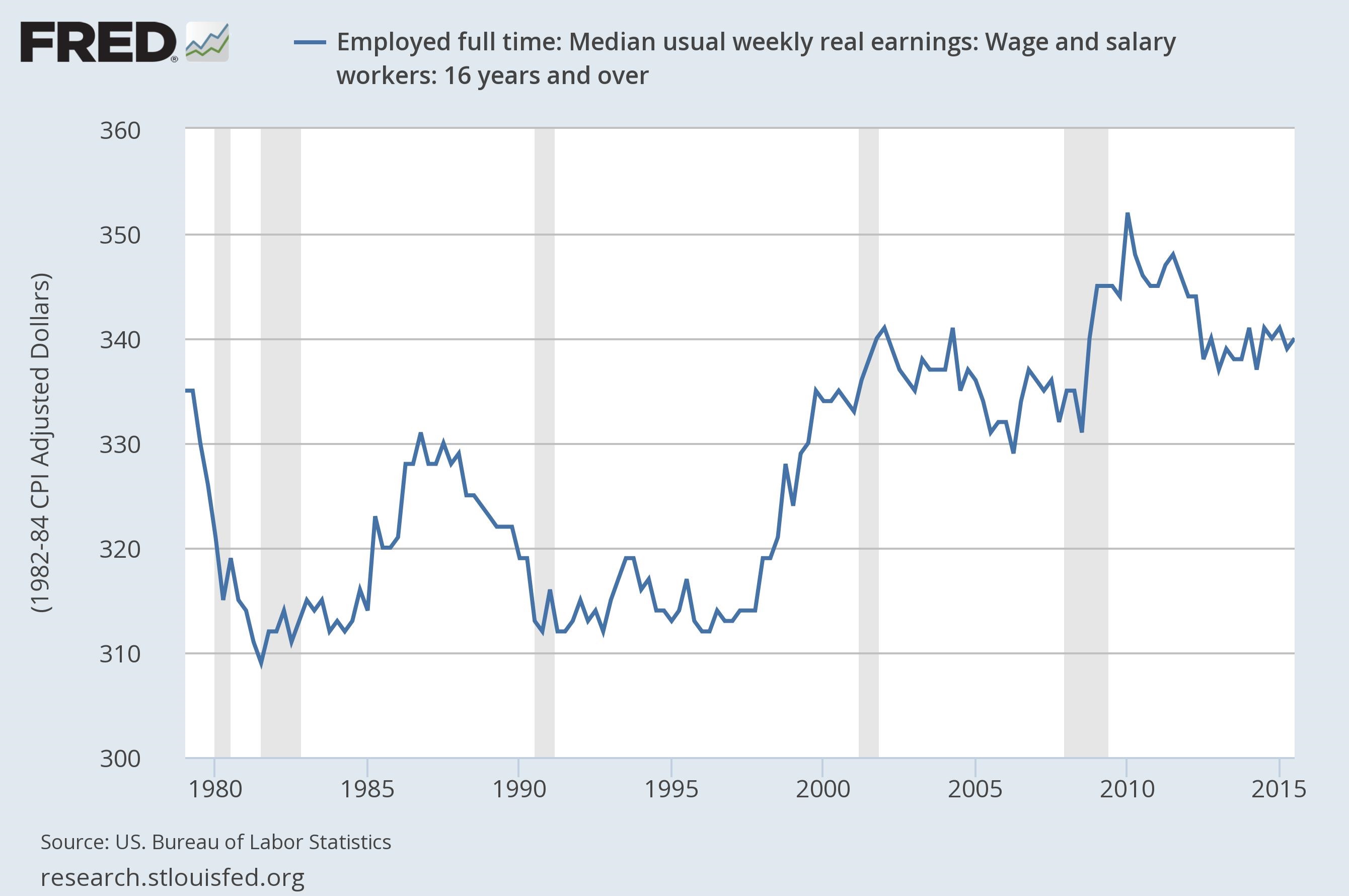

St. Louis Federal Reserve, Accessed December 13, 2015.

—————

The Netherlands seems to be undergoing a sort of industrial revolution in reverse, with jobs moving from factories to homes. The Dutch labor market has the highest concentration of part-time and freelance workers in Europe, with nearly 50% of all Dutch workers, and 62% of young workers, engaged in part-time employment – a luxury afforded to them by the country’s relatively high hourly wages.

Sami Mahroum and Elif Bascavusoglu-Moreau, Is Jobless Growth Inevitable? Project Syndicate, March 25, 2015. Accessed December 13, 2015.

—————

Inequality, exclusion, and duality became more marked in countries where skills were poorly distributed and many services approximated the textbook “ideal” of spot markets. The United States, where many workers are forced to hold multiple jobs in order to make an adequate living, remains the canonical example of this model.

Dani Rodrik, The Evolution of Work, Project Syndicate, December 9, 2015. Accessed December 13, 2015.

—————

Forced labor permeates supply chains that stretch across the globe, from remote farms in Africa and the seas off Southeast Asia to supermarkets in America and Europe. Almost 21 million people are enslaved for profit worldwide, the UN says, providing $150 billion in illicit revenue every year.

Erik Larson, These Lawyers Want Slave Labor Warnings on Your Cat Food, Bloomberg, December 10, 2015. Accessed December 13, 2015.

—————

Over all, the Labor Department data painted a picture of an economy that is growing steadily and creating jobs at a healthy pace, even as wage gains remain subdued and many Americans are still stuck on the sidelines of the recovery.

Nelson D. Schwartz, Robust Jobs Report All but Guarantees Fed Will Raise Rates, New York Times, December 4, 2015. Accessed December 13, 2015.

—————

In reality, the 35-hour workweek has become mostly symbolic, because a multitude of loopholes allow companies to work around the law. French employees work an average of 40.5 hours a week — more than the 40-hour average in the European Union — and have high productivity.

Liz Alderman, Smart Car Standoff Pits Social Progress Against Global Competition, New York Times, December 12, 2015. Accessed December 13, 2015.

COMMENTS

A question emerged after 2008 that unsettled the field of economics and is still unanswered: is this time different? Was the financial crisis of 2008 an economic crisis of a unique kind in the history of capitalism; or was it just a very severe version of a routine kind of economic crisis?

This phrase gained currency from the publication of the book, This Time is Different: Eight Centuries of Financial Folly, by Carmen Reinhart Kenneth Rogoff.[1] They argue that the financial crisis of 2008 is not different. But others disagree.

In a 2012 article, Lawrence King et al make the argument that this time is different because it is the result of a level of financial liberalization and a degree of free market economics that did not exist before the 1970s.[2]

A few of our world’s best and brightest economists expressed their uncertainty and sense that this time is different in this way:

“As a world economic crisis developed in 2008 and lasted longer than most economists predicted, it became increasingly clear that beliefs about macroeconomics and macroeconomic policy needed to be thoroughly examined. … we knew that we had entered a brave new world…”[3]

Different Seems More Likely Than the Same

After 2008 optimism about a return to robust economic growth has been the rule. But actual economic growth has not rewarded that optimism. A few economists have been trying to explain this poor record.

Robert J. Gordon, professor of economics at Northwestern University, recently asserted that “It is time to raise basic questions about the process of economic growth, especially the assumption – nearly universal since Solow’s seminal contributions of the 1950s (Solow 1956) – that economic growth is a continuous process that will persist forever.” He went on to propose that U.S. economic growth may grind to a halt because the kinds of technological innovations that drove rapid U.S. economic growth are not on the horizon.[4]

Professor Gordon was speaking only about the U.S., but the logic would apply to all of the world’s affluent nations. Moreover, the World Bank and other global institutions have repeatedly warned of below par levels of global economic growth, in some cases for years to come.

Weighing anecdotal evidence, some discernible trends, and expert opinion, it seems reasonable to conclude that this time is different for economic growth.

That means this time is almost certainly different for the world of employment.

A Different World of Employment

In mainstream theories of economic development, the future of work is directly tied to the future of economic growth. Economic growth is the engine that pushes us toward the ever expanding prosperity goals that make for widespread affluence: high profits, high wages, and full employment. When economic growth slows down something has to give in the world of employment. We are trapped in a long period of slow economic growth, so the employment trends of the past cannot continue.

We can be fairly certain that workers in the U.S. and other affluent nations will not experience the kind of return to full employment with high wage conditions we have known in the past. In the context of global competition and slow economic growth, the world’s economic and political leaders are pressing hard to cap and reduce wage bills at all levels of employment. We have entered into an era of global degradation of employment.

In affluent nations they are forcing working people to choose between fewer jobs and fewer hours at higher compensation levels or more jobs and more hours with lower wages and less valuable benefits. In the rest of the world, where such a choice has seldom existed in any meaningful sense, global competition and slow economic growth mean an end to the dream of jobs that will deliver better lives. Everywhere, employment rights and workplace protections are falling away.

What we don’t know quite yet is how the ongoing degradation of the world of employment will play out in national and global politics. At the moment it appears that the world’s political and economic leaders have chosen to promote a free-for-all battle struggle among working people by defining rights to crumbs from the capitalist table using the old reactionary lines of difference – race, ethnicity, gender, religion, and nation. And, at the moment, too many workers in affluent nations are falling into this trap, as shown by the rise of Trumpism in the U.S., the growth of reactionary movements across Europe, and the destruction of governing institutions that embody common interests, and the rise of militaristic movements intent on redrawing national boundaries.

Intentionally engendering antagonisms can’t solve the fundamental problems for global economic growth, so the right wing policies can have only one ultimate outcome – a global catastrophe in multiple forms. Hopefully, this will become clear to the world’s working people well before such a catastrophe becomes unavoidable.

———————-

[1] Carmen M. Reinhart and Kenneth Rogoff, This Time is Different: Eight Centuries of Financial Folly, Princeton University Press, 2009.

[2] Lawrence King, Michael Kitson, Sue Konzelmann and Frank Wilkinson Making the same mistake again—or is this time different? Cambridge Journal of Economics 2012, 36, 1–15 doi:10.1093/cje/ber045.

[3] From the Preface: Olivier J. Blanchard, David Romer, A. Michael Spence and Joseph E. Stiglitz, In the Wake of the Crisis: Leading Economists Reassess Economic Policy, MIT Press, 2012.

[4] Robert J. Gordon, Is US economic growth over? Faltering innovation confronts the six headwinds, VOX, September 11, 2012. http://www.voxeu.org/article/us-economic-growth-over.